Our Services

Deep Dive Assessment & Discovery

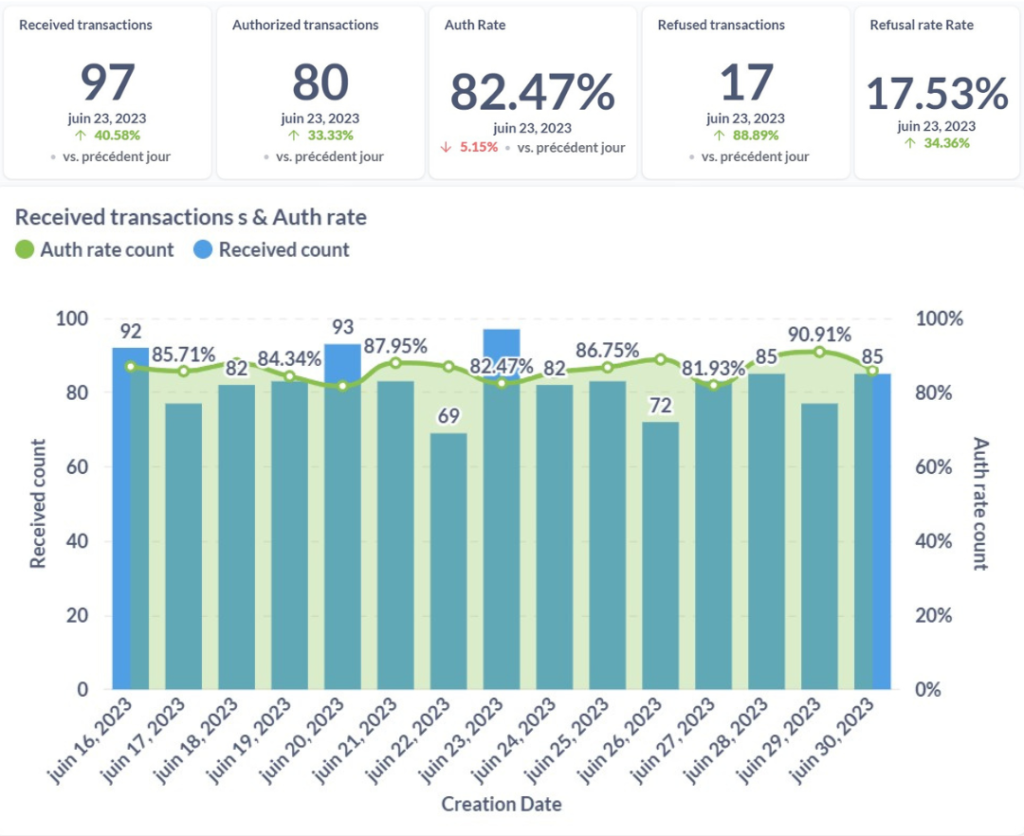

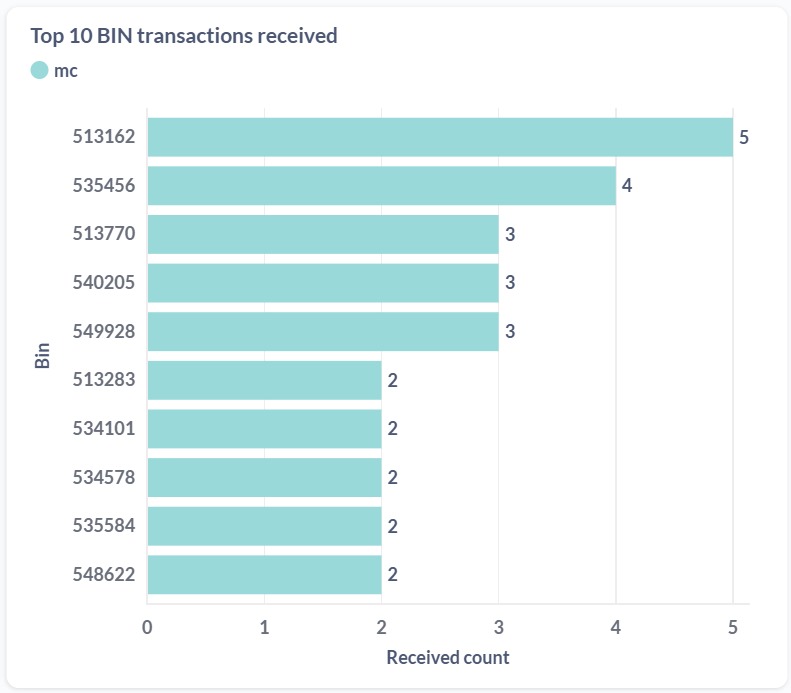

We start by understanding your business, analyzing your payment flows, and identifying where you’re losing revenue through declined transactions or fraud. We Analyze authorization and chargeback data and benchmark against industry best practices to uncover growth opportunities

Strategy Development

Based on our findings, we craft a customized fraud prevention plan aligned with your business objectives and risk tolerance. This includes fraud rule recommendations, technology solutions, and process improvements. We work with you to prioritize quick wins while building a foundation for long-term success.

Implementation

Our team guides you through executing the strategy – whether it’s integrating new fraud tools, implementing rules, or optimizing payment flows. We provide hands-on support to ensure smooth deployment with minimal disruption to your business.

Team Training & Operations

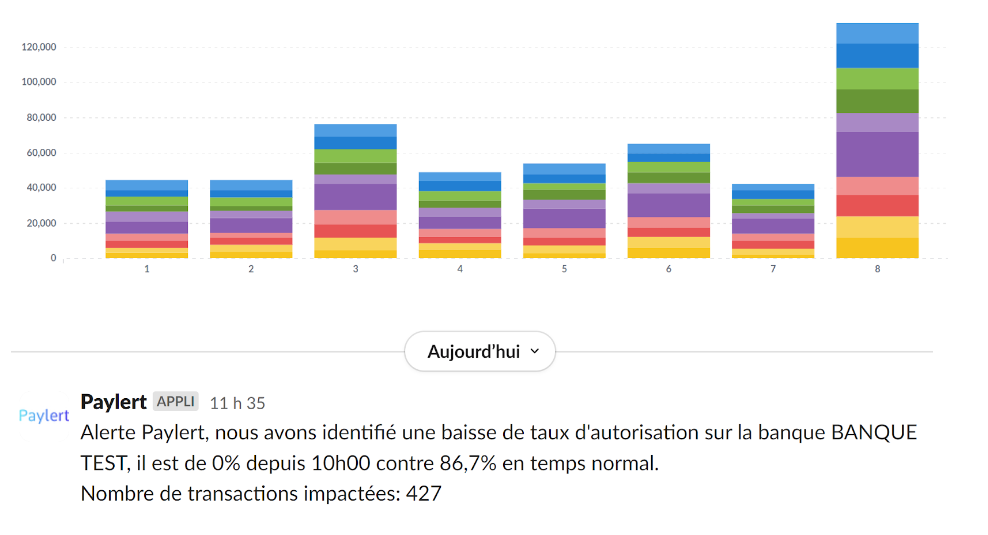

We equip your team with the knowledge and tools they need through comprehensive training sessions and detailed operational playbooks. Our experts work alongside your staff to establish efficient workflows, automated processes, and clear escalation procedures.

Continuous Optimization & Excellence

We track key performance metrics and continuously fine-tune your fraud rules while providing regular strategy reviews and industry updates to keep you ahead of evolving threats. Through ongoing benchmarking, process audits, and refresher training, we ensure your risk management remains optimal as your business grows.